Corporate Highway

Ensure

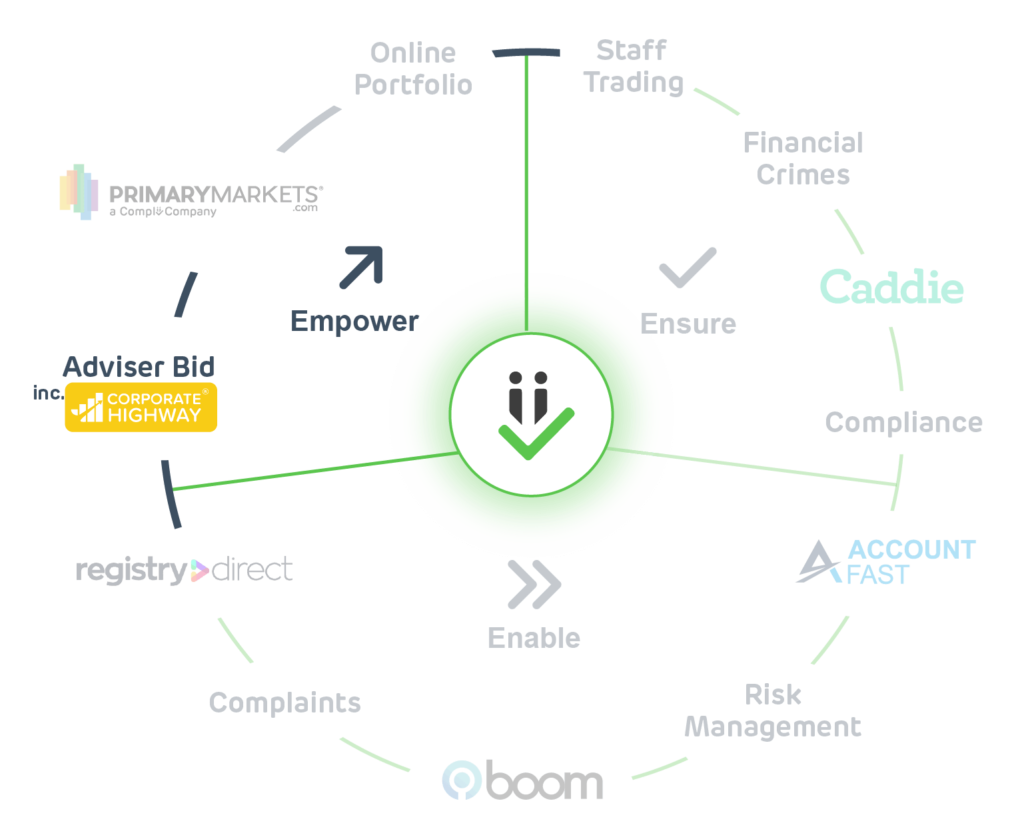

Corporate Highway ensures that deal exposure is limited to appropriate targets, with no risk of exposure to confidential client account data beyond those represented by subscribing firms.

Enable

Corporate Highways enables subscribed advisers to promote client deals more efficiently and success than ever before, as well as enabling time-efficient access for brokers to review a substantially greater flow of investment opportunities.

Enables AFSL holders to execute deals given there is a much wider pool that can now participate in transactions.

Empower

A key feature of Adviser Bid, Corporate Highway empowers access to corporate deal flow and liquidity within the Complii Community creating a significant advantage for subscribed advisers in terms of corporate deal book running delivery.

Alongside PrimaryMarkets, Corporate Highway empowers advisers to harnesses the power of networks to expand their global reach and execution success by using a much larger pool of prospective retail, institutional and private investors.

Next steps

Stay updated with Complii FinTech Solutions company announcements and activities.

Features

Outstanding Advice

Complii can be on an advisors desktop, and/or provide a holistic organisations view to compliance of all outstanding orders requiring advice and action to be taken.

Digital Document Storage

Complii provides a digital document storage solution. All documentation and correspondence can be uploaded and maintained in Complii, from KYC information, client profiles, 708 certificates, SOAs, ROAs, FSGs, T&Cs and more. Requests to update a client profile or to provide a new 708 8 Accountants certificate can be send with a click of a button within Complii to the client and will be recorded in the system. This technology is cost saving to Complii users and efficient as it is the one point for all client information whilst communicating with clients.

Chinese Wall Register

Complii has an inbuilt electronic Chinese wall register. It’s extremely comprehensive and a one of a kind from what we have seen. Once an advisor is placed behind the wall in the system, an auto-generated email is send to the advisor confirming the entry in the register. By clicking on the hyperlink in the email, the advisor acknowledges being placed behind the wall. As we are tied into the OMS (IRESS), any orders placed on that stock by the advisor will send an alert to compliance. This functionality is also used for trade restrictions or blackout periods for Corporate or research activity.

Breach Register

Complii maintains a comprehensive digital breach register that has been designed off ASIC proforma documentation. This stipulates the required information needed for a breach, so the licensee doesn’t need additional information for ASIC. This tool also gives great reporting for ASIC visits and does NOT automatically report to ASIC.

FOFA

Complii makes regulations like FOFA easily managed. It features reporting that shows fee disclosures and when Ópt-in’ is required, plus there is electronic acceptance of FOFA opt in.

Client Profile

Along with the advisor recording client profiles, clients also have the ability to update their own profile online. This profile will be set in Complii and if trading is not in line with profile parameters alerts will be sent to the advisor and a new SOA will auto- generate to be approved and sent to the client.

Document Library

Maintain your internal company compliance through the inbuilt document library which will store company compliance policies and ensure compliance training is alerted to and actioned when required.

CRM and Reporting

Complii has CRM capabilities, where reporting can be generated, printed or send on missing client profiles, outstanding SOAs, ROAs, Expired 708 certificates, 708 nearing expiry certificates, Chinese wall register, missing contract notes plus much more. Internal notes and strategy reviews can be completed and recorded in the system with an inbuilt calendar to notify when the next review is complete.

708 8 Register

The system has a 708 register for clients who meet the requirement. The system will allow certificates to be stored within the system marked with an expiry date, and will send alerts to clients when their certificate is nearing expiry or is expired. This works well for the Corporate bidding system with 708 exempt deals, where the system will only accept bids on clients with a valid certificate and advise advisors if the certificate is out of date. This means no manual visual checks need to be done and efficient and better practices are in place.

708 10 Register

For clients who qualify as an experienced investor, before being asked to participate in any excluded 708 offer are required to complete a statement advising why they meet experienced criteria. This statement goes to senior management or branch management for approval. If approved the client is emailed a declaration and must accept each time they go into an offer. This ensures only clients who are entitled to participate in excluded offers receive the offer letter.

Conflict of Interest

Complii will collate all PA trading and fees received from corporate deals and disclose the amount of PA shares and fees to the client who BUYS/SELLS the stock. This protects the company from future client complaints as it is in line with RG181 which states specific disclosure needs to be given to clients, not ‘may or may not’ hold the stock or received fees from the company traded.

Disclosures

RG181 stipulates that general boilerplate disclosures are inadequate. Complii exceeds this best practice by recording all benefits that may present a conflict of interest. Complii records all conflicts information real time in the system, whether that be Corporate fees, Chess holdings or commissions. These are all presented on advice and offer letters which go out to clients from the system.

Empower you to deliver a broader array of valued client services in more satisfying ways