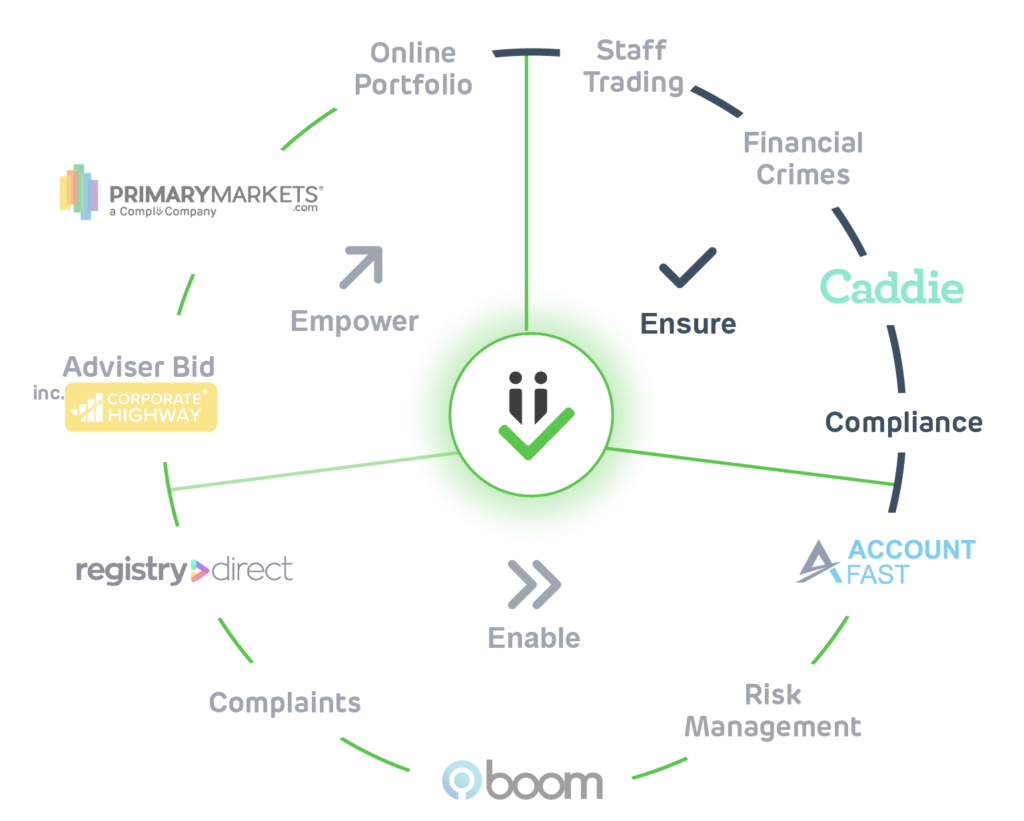

Compliance

Ensure

The Compliance module ensures that AFSL holders meet all their primary obligations in relation to client service delivery and financial transaction management.

Implementing the Compliance model effectively prevents accidental or deliberate breaches of AFSL obligations by individual licence holders.

Transparent capture of all financial advisory and transactional dealings also ensure rapid and successful dispute resolution.

Enable

The Compliance module significantly reduces time and effort required of individual AFSL holders to demonstrate compliance.

Automation of ROA/FOA emails based off client profiles, auto-generation of FOFA FDS letters and many other tasks removes a huge weight of administrative burden from Advisers’ shoulders, freeing them up for more profitable pursuits.

Empower

The Compliance module empowers business managers to assess individual and team performance across a range of key metrics.

For larger businesses, the Compliance module provides transparent visibility of individual Adviser behaviours and adherence to best practice standards.

It empowers them to minimise the behavioural risks that could undermine their precious brand reputation.

Next steps

Stay updated with Complii FinTech Solutions company announcements and activities.

Features

Outstanding Advice

Complii can be on an advisors desktop, and/or provide a holistic organisations view to compliance of all outstanding orders requiring advice and action to be taken.

Digital Document Storage

Complii provides a digital document storage solution. All documentation and correspondence can be uploaded and maintained in Complii, from KYC information, client profiles, 708 certificates, SOAs, ROAs, FSGs, T&Cs and more. Requests to update a client profile or to provide a new 708 8 Accountants certificate can be send with a click of a button within Complii to the client and will be recorded in the system. This technology is cost saving to Complii users and efficient as it is the one point for all client information whilst communicating with clients.

Chinese Wall Register

Complii has an inbuilt electronic Chinese Wall Register. It’s extremely comprehensive and a one of a kind from what we have seen. Once an advisor is placed behind the wall in the system, an auto-generated email is send to the advisor confirming the entry in the register. By clicking on the hyperlink in the email, the advisor acknowledges being placed behind the wall. As we are tied into the OMS (IRESS), any orders placed on that stock by the advisor will send an alert to compliance. This functionality is also used for trade restrictions or blackout periods for Corporate or research activity.

Breach Register

Complii maintains a comprehensive digital breach register that has been designed from ASIC proforma documentation. This stipulates the required information needed for a breach, so the licensee doesn’t need additional information for ASIC. This tool also gives great reporting for ASIC visits and does NOT automatically report to ASIC.

FOFA

Complii makes regulations like FOFA easily managed. It features reporting that shows fee disclosures and when opt-in is required, plus there is electronic acceptance of FOFA opt-in.

Client Profile

Along with the advisor recording client profiles, clients also have the ability to update their own profile online. This profile will be set in Complii and if trading is not in line with profile parameters alerts will be sent to the adviser and a new SOA will auto- generate to be approved and sent to the client.

Document Library

Maintain your internal company compliance through the inbuilt document library which will store company compliance policies and ensure compliance training is alerted to and actioned when required.

CRM and Reporting

Complii has CRM capabilities, where reporting can be generated, printed or send on missing client profiles, outstanding SOAs, ROAs, Expired 708 certificates, 708 nearing expiry certificates, Chinese Wall Register, missing contract notes plus much more. Internal notes and strategy reviews can be completed and recorded in the system with an inbuilt calendar to notify when the next review is complete.

708 8 Register

The system has a 708 register for clients who meet the requirement. The system will allow certificates to be stored within the system marked with an expiry date, and will send alerts to clients when their certificate is nearing expiry or is expired. This works well for the Corporate bidding system with 708 exempt deals, where the system will only accept bids on clients with a valid certificate and advise advisors if the certificate is out of date. This means no manual visual checks need to be done and efficient and better practices are in place.

708 10 Register

For clients who qualify as an experienced investor, before being asked to participate in any excluded 708 offer are required to complete a statement advising why they meet experienced criteria. This statement goes to senior management or branch management for approval. If approved the client is emailed a declaration and must accept each time they go into an offer. This ensures only clients who are entitled to participate in excluded offers receive the offer letter.

Conflict of Interest

Complii will collate all PA trading and fees received from corporate deals and disclose the amount of PA shares and fees to the client who BUYS/SELLS the stock. This protects the company from future client complaints as it is in line with RG181 which states specific disclosure needs to be given to clients, not ‘may or may not’ hold the stock or received fees from the company traded.

Disclosures

RG181 stipulates that general boilerplate disclosures are inadequate. Complii exceeds this best practice by recording all benefits that may present a conflict of interest. Complii records all conflicts information real time in the system, whether that be Corporate fees, Chess holdings or commissions. These are all presented on advice and offer letters which go out to clients from the system.