Account Fast

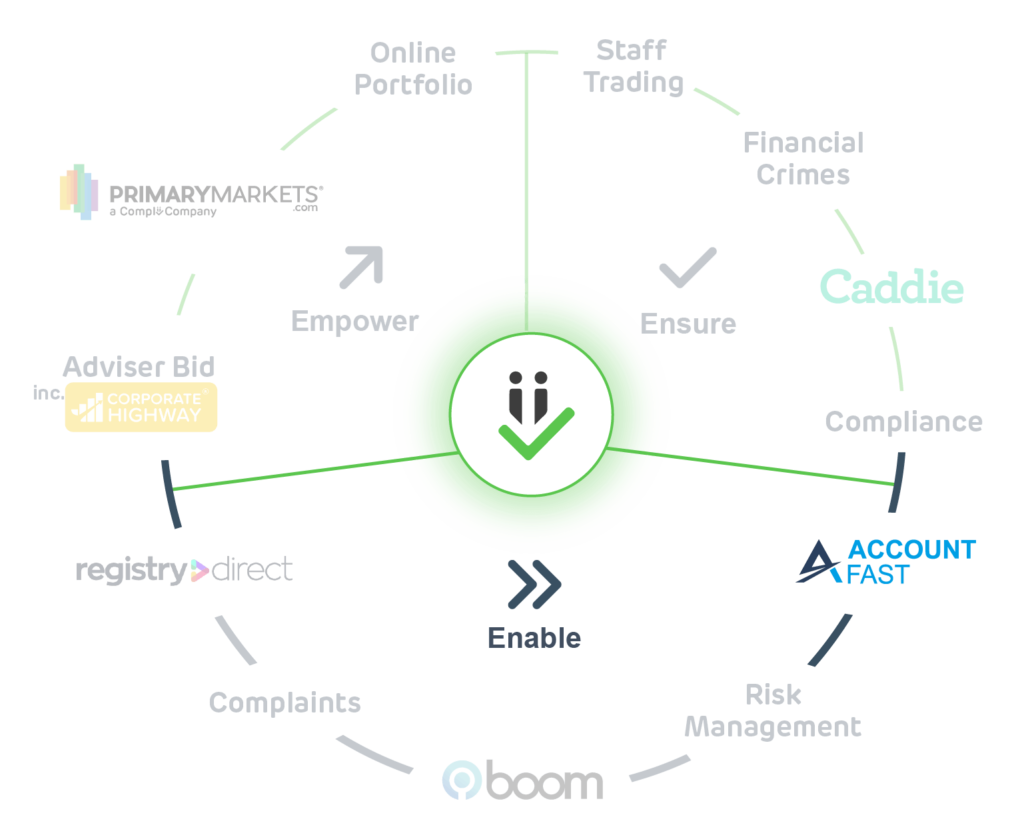

Ensure

Account Fast ensures online client account security by automating the digital ID verification process, combining email and SMS verification for account creation and access.

Enable

Account Fast enables instant, automated account establishment, with smartphone input and capture of relevant client details and documents.

The mobile app prompts clients to provide all required information. Screen-based client signature, identification, credit card capture and verification to save time and minimise risks.

Empower

Account Fast empowers advises to enhance the client on-boarding experience by making it easier and quicker for all involved, wherever they may be.

Next steps

Stay updated with Complii FinTech Solutions company announcements and activities.

Features

Account Information

Once the Complii Account Fast app is downloaded, and you are with a potential client a new client account can be set up within minutes. The app will prompt you for which information is required based on the client type.

Account Identification

All accounts opened will be subject to a green identification check for AML verification. To do this on the go, once the account information is complete, the app will prompt you to take a photo of your clients identification and credit card.

Digital Signatures

Complii Account Fast requires that the client completes a signature, and the advisor verifies the signature with their own signature. This can all be done on the spot, on the app screen.

Electronic Account Creation

Once all account information is added, identification photographed, signatures are done, AML verification complete, an email and SMS is sent to the client to electronically accept. Upon acceptance by the client, the account is auto-created.