Customised and modular flexibility

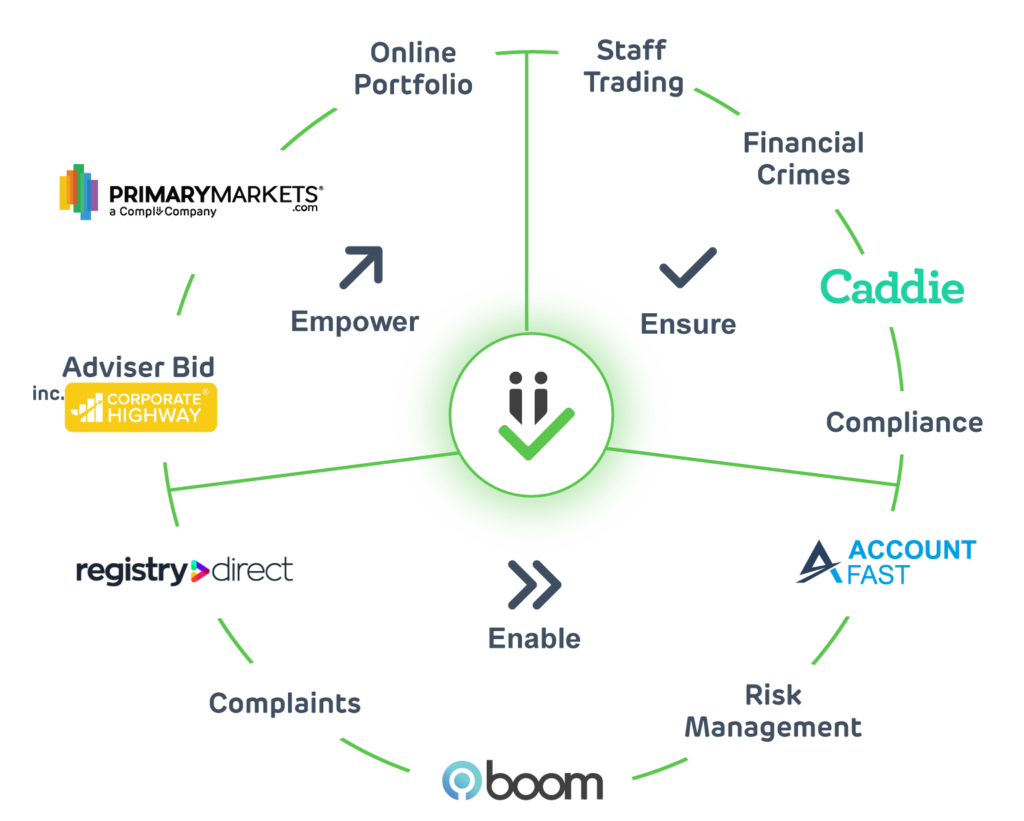

Designed to meet AFSL holders’ specific operational needs, Complii FinTech modules can be implemented individually or as part of an integrated service delivery platform.

While most modules deliver across all three areas, the core functionality of each is most aligned with one of the three.